How different are the needs and priorities of large vs small van fleets? What do they look for in fleet vans? Is it just a question of the number of vehicles, or do the differences go deeper than that?

As Fleet Sales Manager at Vansdirect, Simon Brown has a ringside seat and unique insight into fleet van sales and fleet van leasing.

Subscribe to The Fleet Insider to hear more discussions with fleet professionals.

“If you see that van out and about and it’s got [Company Name] on the side and it’s rusty, it’s scruffy… You look at it and you go, I’m not going to use them. If you’ve got a nice clean van, you keep on top of your fleet… and you keep your staff happy, you keep bringing in more business. It pays for itself.”

The Fleet Insider, episode 5: Simon Brown Fleet Sales Manager at Vansdirect

In this podcast episode Simon and James discuss how they think fleets are leveraging telematics technology, the change in the demand of fleet vehicles and how small and large fleets operate differently.

Market fluctuations

One key trend Simon has observed is the dramatic rise in fleet van prices over the last couple of years, due to shortages of key parts and supply chain issues.

“Since I came into the trade in December of 22, the market has changed so much. Van prices were at an all-time high… the market was driven up in price, whereas now it’s starting to come back down again.”

Despite the recent falls, prices have yet to reach the lower levels of 3 or 4 years ago.

“For example, a small vehicle like a Citroen Berlingo used to be about £13,000 new, whereas now you’re looking £20,000to buy the exact same thing.”

The increased costs of new vehicles put companies in a difficult position, as that cost must either be absorbed or recouped by raising prices for customers.

Length of vehicle retention

One trend Simon has noticed is that companies are retaining vehicles for longer rather than replacing them with newer models

“So generally larger fleets that are running maybe 100 odd vehicles, will upgrade after three years when the warranties are up because the vehicle’s started to wear a little bit, the maintenance costs increase and so on so forth…Whereas some companies now are saying, well, it’s cheaper to pay the maintenance costs on the cheaper vans we bought three years ago than actually upgrade and buy a new vehicle that’s six grand more expensive”

Brand impact of company vehicles

Simon points out that many do not realise that running a fleet of any size is a lot more involved than “just buying a van and putting it on the road. There’s so many other factors that go into it and keeping staff happy as well, you know. “

Whether new or second hand, a company’s fleet of vans are an expression of their identity and public image. Simon notes “Having a rusty van on the road versus a brand-new vehicle, you’ve got to think about company image.”

“If you see that van out and about and it’s got [Company Name] on the side and it’s rusty, it’s scruffy… You look at it and you go, I’m not going to use them”

Companies who manage and maintain their vehicles are communicating something about how they run their business more generally and inspire confidence in their customers, partners and teams.

“If you’ve got a nice clean van, you keep on top of your fleet… and you keep your staff happy, you keep bringing in more business. It pays for itself.”

Priorities of different fleet sizes

Vansdirect work with companies of all sizes, from small trades businesses to large corporations with hundreds of vehicles on the road. As a result, Simon sees the different needs of vehicle owners and fleet managers.

At the smaller end of the market, owners have different needs to consider as the vehicles often do double-duty as personal transport as well as work vehicles.

“If I was a one man band, I probably would be more particular because I would probably get rid of my car and just use that as my go to vehicle day-to-day.”

In the case of large fleets, vehicles are for work-use only and the cost of ‘extras’ for multiple vans can add up considerably. Here, luxuries like heated seats are out in favour of a more functional approach.

The key things for a Fleet Manager at a large organisation running a number of vans, Simon says, will be that “The van’s the right size, it’s capable for the job and it’s reliable.”

This contrasts with Simon’s experience in a previous role.

“I’m from the car background. So I’ve done lease cars for 5-6 years and the requirements of a car customer was always very particular. They’d want a particular colour; they’d want a certain trim. Especially if you’re ordering something like a Land Rover that would cost £100,000, you’d want it to be exactly what you want. Whereas with a van, it’s a tool at the end of the day.”

The role of telematics

Simon sees van tracking used across the board by his customers, but particularly amongst companies with more than a couple of vehicles, where manual management becomes more challenging. “If you’ve got 10 plus [vehicles] it’s, it’s a massive relief for a lot of fleet managers.”

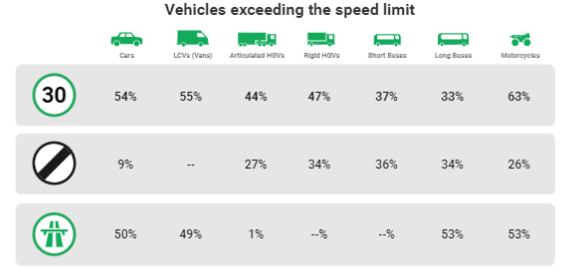

“If you want longevity for your vehicles, to be on the road for longer, it’s crucial to make sure your drivers aren’t disrespecting the vehicles…Yes, you can put speed limiters on up to 70 mile an hour, but how do you know that drivers not doing 50 in a 30?”

He recounts a recent conversation with a customer who had purchased a minibus and equipped it with vehicle tracking.

Shortly after collection, the manager realised his driver was doing 90 miles per hour on the motorway.

In Simon’s words “It’s very rare that this happens on a minibus on a motorway!… if a bit of wind hit him, it would have blown the bus over a bridge. So you’ve got to keep an eye on what’s going on because you don’t know what your drivers are doing.”

Considerations when moving to electric commercial vehicles

EV commercial vehicles have been a hot topic for the last couple of years and Simon points out that bringing these on board poses additional challenges to Fleet Managers used to the availability of liquid fuels, either at depots or on the road.

“I’ve supported quite a few larger organisations where the drivers do, you know, 30,000 miles a year and it just wouldn’t work for them because of the downtime for the vehicles being charged.”

Companies looking to move to EV’s should also consider the infrastructure needed to support the new vehicles. “If they run a fleet of 100 vehicles, where do you charge 100 vehicles?”

Whilst the ideal for businesses with their own energy tariffs is to charge them onsite overnight “If you’ve got an old building, the wiring might need to be completely redone .. to get the charge points in. It might not have the sufficient wattage to power all the charge points in one hit.”

And when out on the road recharging poses more challenges than an old-fashioned stop at a petrol station, with time taken to fully charge. “If you’ve got drivers out on the road, do you allow them an hour downtime to charge at a public point?”

As with ICE vehicles, the cost of electric vehicles has fluctuated considerably over the last couple of years, with more recent drops in price.

In Simon’s words; “They’ve bottomed out the market. The Maxus T-90 for example, when it first was released was around £50,000 and then at Christmas you could buy one for £20,000, which was outrageous.

They sold out pretty quickly because they’re bringing new models out.”

Companies need to look carefully at the range and payload of the fleet vans they are choosing. Does the range on a full charge meet that needed to operate without interruption? Is the payload comparable to an ICE version? Can the vehicle “do the job that they need it to do”?

“If you can get 300 mile electric range that would suit most businesses and if you can fast charge them and the payloads are still the same… it could work”

However, Simon concludes, “I think there’s a lot of work to be done in regard to the EV market, in my opinion.”

Tips when choosing new vehicles

Speak to people in the industry

“Talk to people in the industry, somebody like myself, I tend to deal on a non-pressured basis. So, I would talk to anybody that needs advice without the pressure of them having to buy from me in the future.”

Speak to your team

“Speak to the drivers and the people who are running the vehicles as well… work out what their challenges are as the drivers of the vehicles”

Take a look at your competitors and what is working for them

“I think no matter what industry you’re in, you can learn a lot from your competitors” Look into what other businesses in your industry are doing so you can… learn from that.”

Your van fleet FAQs

When looking for finance on a new van there are a number of options available, the three most common being van leasing, contract hire, and hire purchase.

Van leasing can allow a flexible payment schedule, the opportunity to recover VAT, and the ability to upgrade your van deal every few years. The structure will depend on the provider but in most cases you will pay an initial rental, followed by monthly rental payments for the agreed length of your contract. If you want to keep the van at the end of the contract, you can then make what is known as a final balloon payment at the end of your contract – or the van can be sold, with you collecting any available equity from the profits.

With contract hire new van deals, you will always return the van at the end of your contract. As with leasing, the payment structure may vary but you are likely to pay the initial rental and agree monthly instalments until the end of your term. Once the contract has ended and the van has been returned, you have the option to look at other new vans.

Hire purchase allows you to own your van outright. You will pay a deposit on a new van, and then monthly instalments for the duration of your agreement. Once the contract is up, the van belongs to you.

Contract terms will vary depending on supplier, but can range in length from two to five years. Listed prices may differ based on the type of van finance you want to use.

When choosing a van you need to consider the size you need based on the work you need your company to perform.

Vansdirect have put together a useful guide to help you choose the right van for your particular needs and requirements.

The cost of insurance will vary depending on your particular circumstances but according to Checkatrade, “Van fleet insurance is cheaper than buying individual insurance policies for each vehicle your business owns. However, it’s hard to say how much you should pay for van fleet insurance as there are many variables within a policy. Theses include: The number and type of vehicles in the fleet The type of cover you opt for (Third Party Only, Third Party Fire & Theft, or Comprehensive cover) Whether you choose to have an ‘any driver’ or a ‘named driver’ policy Whether you want to include any optional extras, e.g. goods in transit insurance”

You can find more information in this article from Checkatrade.

Where to listen to the podcast?

To hear more insights and guidance from Simon and other fleet professionals, head over to our podcast channel and choose your preferred platform to listen. We hope you enjoy this episode and join us for more discussions from a range of industries over the coming months!