See for yourself how Quartix works with our fully interactive real-time demo.

Navigating the world of vehicle taxation can be a complex task. This is especially true when it comes to Benefit-in-Kind (BIK) tax. Recent changes to the classification of double cab pickups (DCPUs) have sparked significant debate. Here’s everything you need to know.

Double cab pickups have gained popularity due to their versatility. They serve both personal and commercial needs, making them a favourite among businesses and individuals alike. However, new regulations set to take effect in April 2025 will reclassify many double cab pickups as cars for tax purposes, significantly shifting the financial landscape for owners and users.

Understanding these changes is crucial. It can affect your tax liabilities and overall cost of owning or using these vehicles for your business. This article aims to guide you through these changes. It will provide insights into the new BIK landscape and how to navigate it when considering double cab pickups.

Understanding Benefit-in-Kind (BIK) Tax

Benefit-in-Kind (BIK) tax is applied to perks or benefits that employees receive from their employers. This includes company vehicles, such as double cab pickups, which are often used for personal journeys.

The tax is calculated based on the vehicle’s value and emissions. Higher emissions typically result in increased BIK costs, impacting the overall tax paid by the employee or company.

For businesses, offering a company vehicle can be an attractive employee benefit. However, understanding the BIK implications is essential to manage costs effectively. Staying updated on changes helps in making informed financial and operational decisions regarding vehicle use.

The Rise of DCPUs

Double cab pickups have become increasingly popular in recent years. Their versatility makes them suitable for both work and leisure activities, appealing to a broad audience.

These vehicles offer spacious interiors and practical payload capacities. This makes them an excellent choice for individuals who need a vehicle for both private and business needs.

The robust design of double cab pickups caters to outdoor enthusiasts and professionals alike. They are often used in industries requiring durable transport solutions. DCPUs provide the performance needed for challenging terrains and demanding tasks.

Key Changes to BIK Tax for Double Cab Pickups

Double cab pickups offer unique tax benefits for businesses. Historically, they have qualified as commercial vehicles, opening access to financial perks such as the ability to claim VAT and favourable depreciation rules. However, this is now contingent on the vehicle meeting specific criteria, particularly a payload capacity of at least one tonne (1000 kg).

These recent adjustments to the Benefit-in-Kind (BIK) tax system have caught the attention of those considering double cab pickups. From April 2025, vehicles that do not meet the one-tonne payload threshold will be reclassified as cars for BIK purposes, leading to higher tax liabilities. This change follows a 2020 Court of Appeal ruling, which clarified that multipurpose vehicles with significant personal use potential should be treated as cars for tax purposes.

Key updates:

- Stricter Emissions Testing: Under the Worldwide Harmonised Light Vehicle Test Procedure (WLTP), double cab pickups will face revised CO2 emissions thresholds that influence their BIK percentages.

- Clearer Classification Rules: Vehicles must now meet the one-tonne payload threshold, excluding removable items like hardtops or tools, to retain their status as commercial vehicles.

- Transitional Arrangements: Vehicles purchased, leased, or ordered before April 6, 2025, can retain their current tax treatment until disposal, lease expiry, or April 5, 2029.

- Business/Personal Usage Reporting: Clearer distinctions between personal and business use applications are now required.

These changes significantly alter the tax landscape, increasing the financial burden on vehicles that fail to meet the new criteria. Companies and individuals need to assess the financial implications associated with owning DCPUs carefully.

Vehicle Excise Duty (VED) and Double Cab Pickups

While BIK classifications are changing, Vehicle Excise Duty (VED) rules remain unchanged. Double cab pickups will continue to be taxed as light goods vehicles (LGVs) for VED purposes. For example, the annual VED rate for LGVs will rise modestly from £335 to £345 in the 2025/26 tax year, remaining significantly lower than rates for cars.

Commercial vs. Personal Vehicle Use: A Tax Perspective

The tax implications of using DCPUs significantly vary based on their use. Distinguishing between commercial and personal applications is essential for accurate tax assessments.

When a pickup is primarily used for business, it could qualify as a commercial vehicle, which often results in favourable tax treatment.

Conversely, vehicles predominantly used for personal purposes, beyond commuting or incidental travel, face different tax considerations. These may include higher BIK rates, due to the personal benefit derived from the vehicle, and this may classify the vehicle as a ‘car’ for tax purposes.

A Fleet News Roundtable on the topic emphasises HMRC’s stringent stance on private use of DCPUs.

Businesses must maintain detailed records of vehicle usage to ensure correct classification of business and personal mileage. Proper documentation can help avoid unnecessary tax burdens and prove commercial intent.

While double cabs often serve dual purposes, combining business functionality with personal convenience, companies must establish clear policies and ensure drivers understand the limitations of private use.

To ensure compliance, businesses should document and justify all vehicle usage and regularly audit journey logs.

Get the Guide

For tips on classifying business and personal mileage in your fleet tracking system, see our user guide.

Calculating BIK for Double Cab Pickups

Determining the BIK for double cab pickups involves several factors. The process starts with identifying the vehicle’s P11D value. Next, the CO2 emissions of the pickup are considered – higher emissions generally lead to increased BIK rates.

Fuel type is also a consideration. Diesel, petrol, and electric variants influence the percentage applied to the P11D value, adjusting the BIK amount.

Finally, the specific BIK rate, determined by government guidelines, will convert the determined value into the taxable benefit. Each element combines to finalise the BIK sum, making accurate information of your vehicle specification and usage essential.

HMRC Reversal and Industry Impact

In September 2024, HMRC reversed its earlier stance on reclassifying all double cab pickups as cars. This U-turn ensures that vehicles meeting the one-tonne payload threshold will continue to qualify as commercial vehicles for BIK and capital allowances, mitigating some of the financial impacts anticipated under the Autumn Budget 2024.

This decision followed significant lobbying by the farming and motor sectors, which highlighted the detrimental impact on businesses. Nigel Huddleston, Financial Secretary to the Treasury, said: “We will change the law at the next available Finance Bill in order to avoid tax outcomes that could inadvertently harm farmers, van drivers and the UK’s economy.”

Navigating the New BIK Rules: Tips and Strategies

Understanding BIK implications helps make informed decisions. Engaging a tax professional can offer valuable guidance as they provide insights into optimising BIK rates and ensuring compliance. If you are assessing the vehicles in your business fleet, consider the following strategies:

- Opt for Low-Emission Pickups: Choose models with lower emissions to reduce BIK liabilities.

- Evaluate Vehicle Purpose: Determine whether the vehicle will be primarily for business use.

- Consider Leasing: Leasing could offer flexibility and mitigate risks associated with ownership.

- Stay Informed: Regularly review tax law changes to stay compliant and minimise surprises.

For fleet managers and businesses, the changes to BIK and double cab pickups require proactive strategies:

1. Audit Fleet Vehicle Specifications and Payloads

Review the specifications of all double cab pickups in your fleet to confirm their payload capacity meets the commercial vehicle threshold.

2. Update Vehicle Usage Policies

Clearly define permitted use for double cab pickups. Communicate these policies to drivers and ensure they understand the financial implications of non-compliance.

3. Track Business and Personal Mileage

Implement systems to monitor vehicle usage, including mileage, destinations, and time spent on personal vs. business travel.

4. Plan for Additional Costs

Adjust fleet budgets to account for any vehicles that may now fall under higher BIK rates due to reclassification.

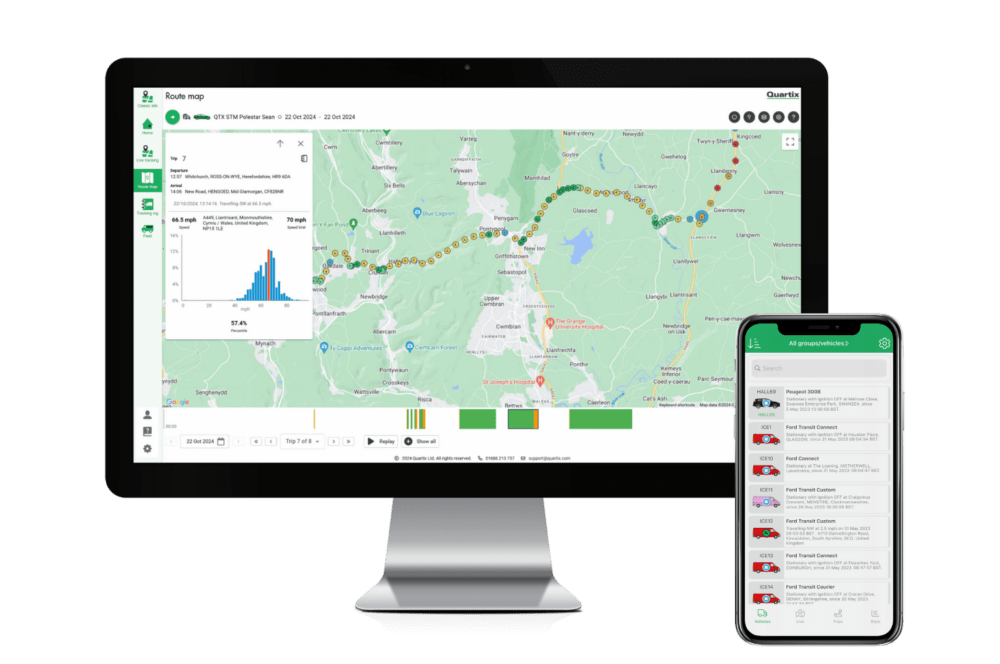

As a fleet tracking provider, we understand the challenges businesses face in navigating tax regulations while maintaining operational efficiency. Our telematics solutions offer a powerful toolkit to help address these challenges:

Real-Time Usage Monitoring: With GPS tracking, you can monitor vehicle movements in real time, ensuring compliance with business-only travel policies.

Automated Reporting: Generate detailed vehicle usage reports that document business vs. private mileage, simplifying compliance with HMRC requirements.

Geofencing Alerts: Set up geofences around designated work zones to track and restrict non-business travel or travel within specified hours.

Driver Education: Educate drivers about optimal vehicle use and the financial consequences of private travel, with Driver ID to track individuals’ usage of shared vehicles.

Optimised Fleet Composition: Analyse vehicle usage data to determine whether double cab pickups are the best fit for your fleet or if alternatives might better align with business needs.

Industry Insights and Preparing for the Future

This Fleet News discussion provides essential clarity on HMRC’s stance regarding private use of double cab pickups. Participants stressed the importance of robust documentation and policy enforcement to mitigate compliance risks.

Fleet tracking systems can play a crucial role by automatically recording and categorising trip data, ensuring businesses stay within regulatory boundaries.

The recent changes and HMRC’s subsequent reversal highlight the importance of vigilance in fleet management. By staying informed and adapting to tax regulations, businesses can navigate these changes effectively.

Partnering with a trusted fleet tracking provider ensures you have the tools to minimise liabilities and maintain operational success.