Filing IFTA (International Fuel Tax Agreement) taxes doesn’t have to be a headache. Quartix’s IFTA calculator gives you the numbers you need, in the required format, within seconds. You’ll also be able to:

- Get accurate mileage and taxable gallons

- Reduce your paperwork

- Save time and decrease your stress

IFTA and your business

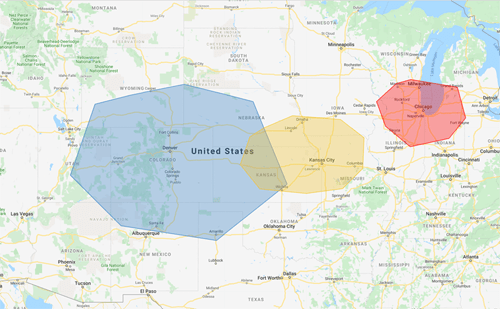

Most likely, you already know if you’re required to pay IFTA taxes on your vehicles. If you aren’t sure, IFTA taxes are due in 48 US states (excluding Hawaii and Alaska) and the Canadian provinces, by motor carriers that operate in more than one jurisdiction. It’s required for the following vehicles:

- Two axles and a gross vehicle weight in excess of 26,000 pounds

- Three or more axles

Exceptions exist for recreational vehicles, like motor homes, that are exclusively used for non-business purposes. Individual states have individual requirements, so it’s best to check the criteria for each jurisdiction, however the Quartix calculator gives you the essential information you need for filing.

How does the Quartix calculator work?

While you and your drivers are on the road, Quartix tracking devices identify and record the miles you travel in each IFTA region using GPS coordinates. Any miles travelled in non-IFTA areas are labelled as such.

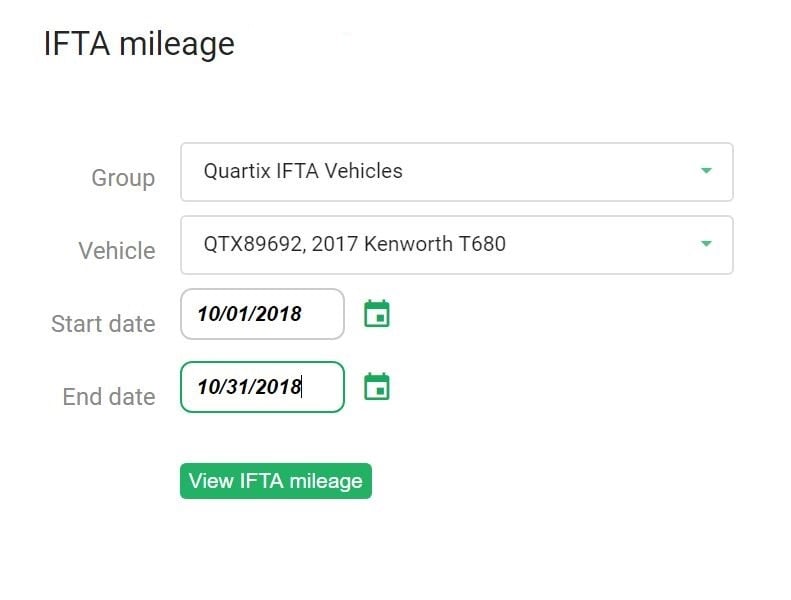

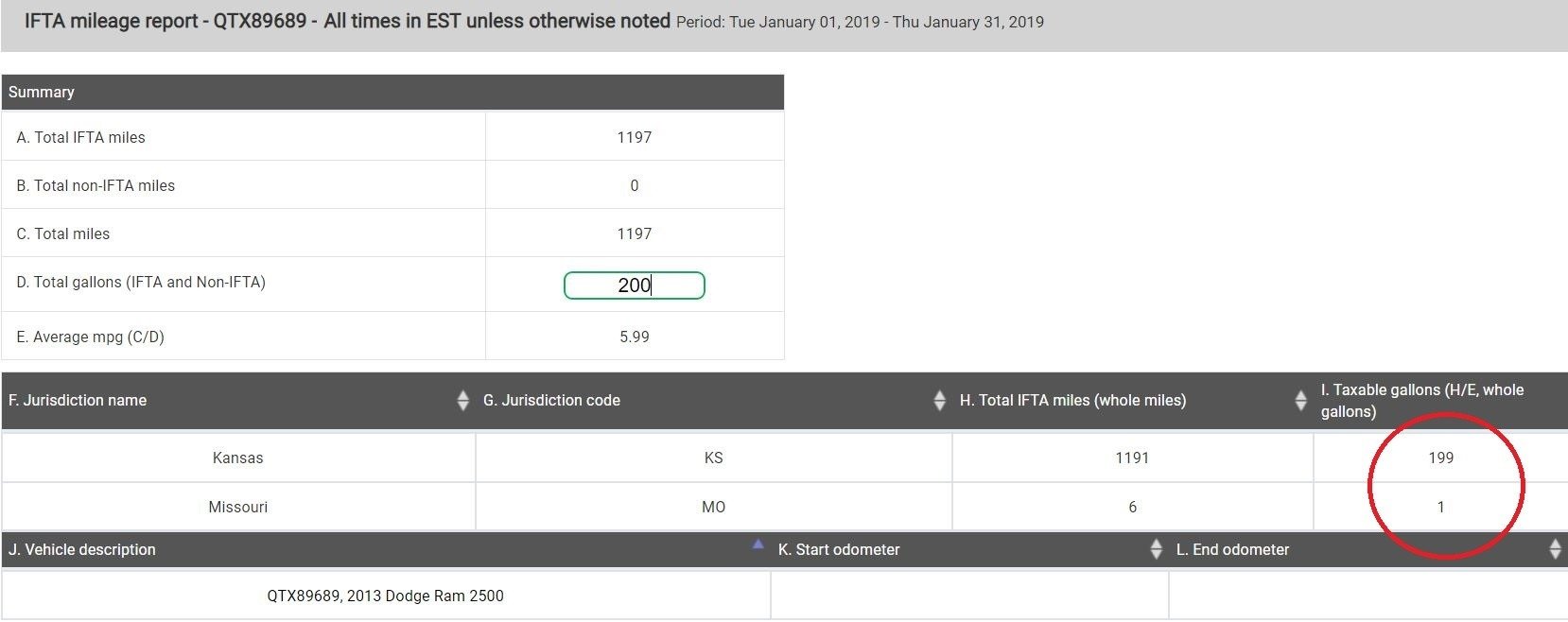

When it’s time to file, simply select the vehicle and identify the time you want to calculate for.

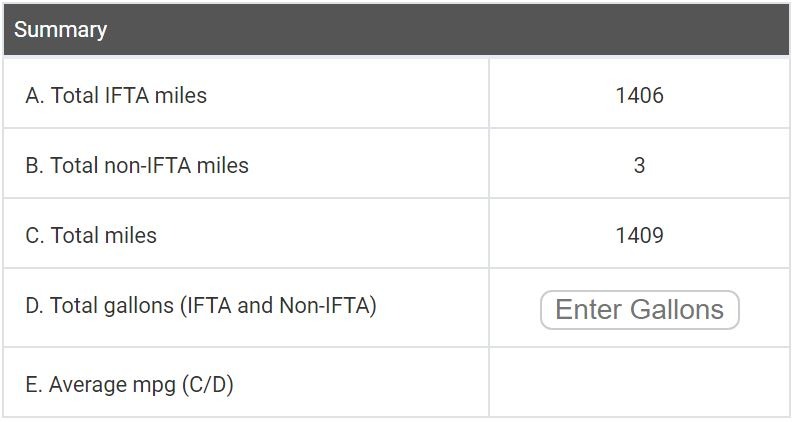

Entering the total gallons purchased into the tax calculator, including fuel spent in non-IFTA areas, automatically gives you the number of taxable gallons. The calculator can filter out the non-IFTA miles, so you don’t have to.

The taxable gallons are divided into each IFTA area that the vehicle travelled in during the specified time. Quartix calculates this from the miles tracked in each jurisdiction, providing you with the critical data you need to file your IFTA taxes.

How can having this data help me?

The Quartix IFTA tax calculator reduces the amount of time you spend on paperwork by giving you the taxable gallons for each of your vehicles, in every IFTA jurisdiction you travel through, in a format that’s easy to read and understand. Using the calculator when you file IFTA taxes helps you by:

- Providing the miles travelled in both IFTA and non-IFTA areas

- Ensuring the taxable gallons you’re reporting are correct

- Eliminating the need for paper mileage records

For more information on the Quartix IFTA tax calculator, please contact our sales team at 1-855-913-6663 or email [email protected].